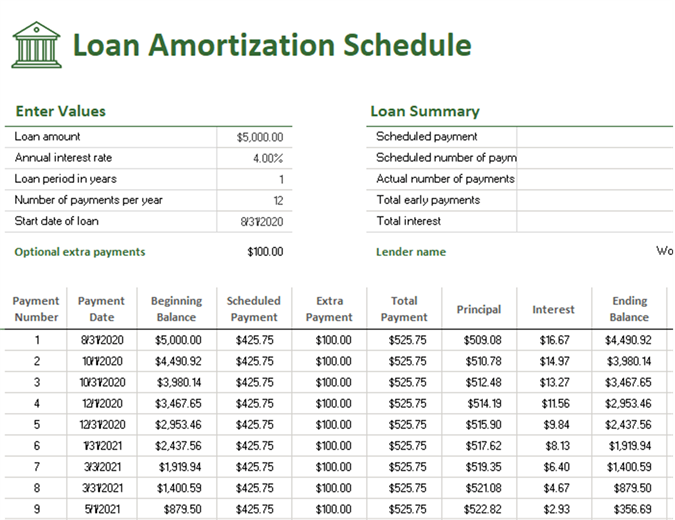

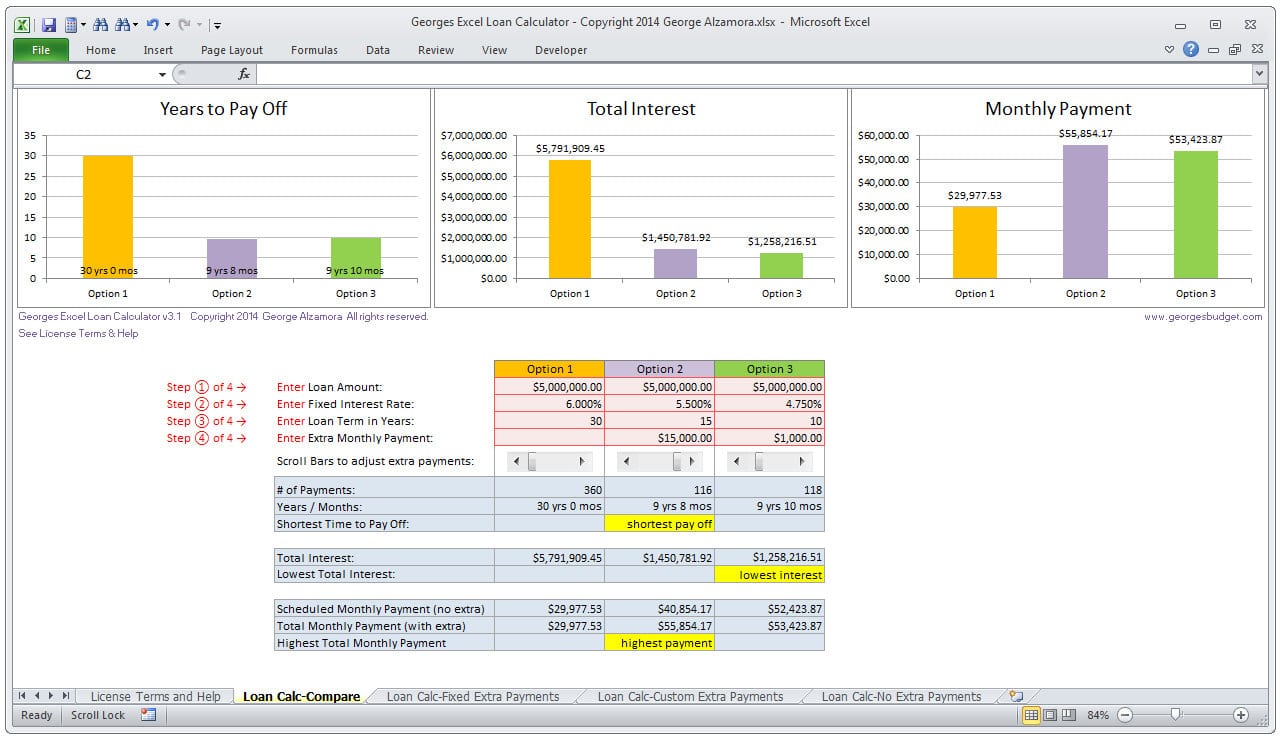

You can also add extra monthly payments if you anticipate adding extra payments during the life of the loan. To use the calculator, input your mortgage amount, your mortgage term (in months or years), and your interest rate. Figure out how much equity you have in your home.See how much interest you have paid over the life of the mortgage, or during a particular year, though this may vary based on when the lender receives your payments.Determine how much extra you would need to pay every month to repay the full mortgage in, say, 22 years instead of 30 years.Determine how much principal you owe now, or will owe at a future date.This means you can use the mortgage amortization calculator to: How much time you will chop off the end of the mortgage by making one or more extra payments.How much principal you owe on the mortgage at a specified date.How much total principal and interest have been paid at a specified date.How much principal and interest are paid in any particular payment.How do you calculate amortization?Īn amortization schedule calculator shows: A portion of each payment is applied toward the principal balance and interest, and the mortgage loan amortization schedule details how much will go toward each component of your mortgage payment.

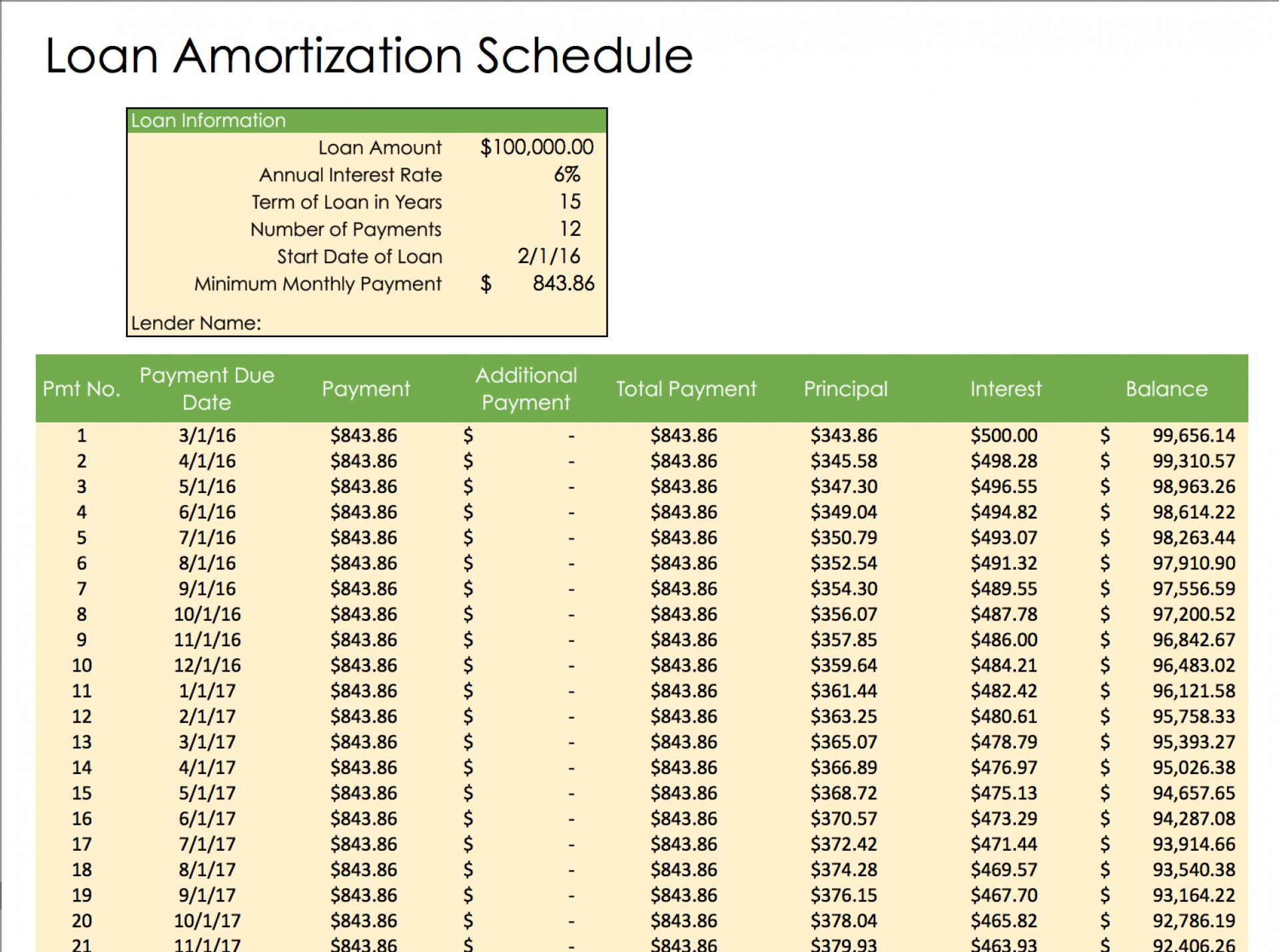

The loan amortization schedule will show as the term of your loan progresses, a larger share of your payment goes toward paying down the principal until the loan is paid in full at the end of your term.Ī mortgage amortization schedule is a table that lists each regular payment on a mortgage over time. Initially, most of your payment goes toward the interest rather than the principal. The downside is that you’ll spend more on interest and will need more time to reduce the principal balance, so you will build equity in your home more slowly.

With a longer amortization period, your monthly payment will be lower, since there’s more time to repay. Over the course of the loan, you’ll start to have a higher percentage of the payment going towards the principal and a lower percentage of the payment going towards interest. If you take out a fixed-rate mortgage, you’ll repay the loan in equal installments, but nonetheless, the amount that goes towards the principal and the amount that goes towards interest will differ each time you make a payment. Over the course of the loan term, the portion that you pay towards principal and interest will vary according to an amortization schedule. Each month, your mortgage payment goes towards paying off the amount you borrowed, plus interest, in addition to homeowners insurance and property taxes.

0 kommentar(er)

0 kommentar(er)